Top Trends 2024

As of 2024, the search engine market share in China is still primarily dominated by Baidu, which holds the largest share of the market. However, other search engines like Sogou and Shenma also play significant roles. Here's an overview of the top trends in the Chinese search engine market for 2024:

Baidu Continues Dominance: Baidu maintains its position as the leading search engine in China, serving as the go-to platform for most Chinese users' search queries. Its focus on AI-driven search technology and diversified services keeps it ahead of competitors.

Mobile-First Approach: With the increasing adoption of smartphones and mobile internet usage in China, search engines are prioritizing mobile optimization. Mobile-friendly interfaces, fast-loading pages, and seamless user experiences are essential for search engine success.

Voice Search Integration: Voice search is becoming increasingly popular in China, driven by advancements in natural language processing and the proliferation of smart devices. Search engines are integrating voice search capabilities to accommodate users' preferences for hands-free interactions.

AI and Machine Learning: Artificial intelligence (AI) and machine learning are integral to enhancing search engine algorithms, improving search accuracy, and personalizing search results. Search engines are leveraging AI technology to deliver more relevant and personalized search experiences to users.

Vertical Search Expansion: Chinese search engines are expanding their offerings beyond traditional web search to include vertical search features like image search, video search, news search, and e-commerce search. This diversification aims to provide users with more comprehensive search experiences tailored to their specific needs.

Localization and Cultural Sensitivity: Chinese search engines prioritize localization and cultural sensitivity in search results to better serve the unique preferences and behaviors of Chinese users. Understanding local dialects, customs, and cultural nuances is crucial for effective search engine optimization in China.

Privacy and Data Security: Concerns about privacy and data security continue to shape search engine usage trends in China. Users prioritize platforms that offer robust data protection measures and transparency in data handling practices.

Integration with Super Apps: Super apps like WeChat and Alipay have become integral parts of daily life for many Chinese users, offering a wide range of services beyond messaging and payments. Search engines are integrating with super apps to expand their reach and offer seamless access to search functionality within these platforms.

Content Quality and Authority: Search engines prioritize high-quality, authoritative content in their search results to provide users with accurate and reliable information. Content creators and publishers focus on producing informative, engaging, and trustworthy content to improve search visibility and user satisfaction.

Competition from New Entrants: While Baidu remains the dominant player, emerging search engines and tech companies are entering the market, intensifying competition. Startups and tech giants alike are investing in innovative search technologies and services to challenge established players and capture market share.

The aim of this article is an idea of B2B marketers why search engine marketing in China is important to give, and why Chinese search engines differ from Google or Bing or other Western search engines.

Baidu number One

A large user base and a broad business adoption

First, let me offer a few statistics, the width and depth of the online marketplace in China illustrate. According to data from CNNIC (China Internet Network Information Center), as of December 2015, there were 566 million people using search engines that for the majority of Chinese Internet users (82.3 percent) and there is an increase of 44 million users accounts year -over-year. In comparison, there are an estimated 219 million users of search engines in the United States in 2016, which was only 4 million more than, 2015.

Users will not only personal searches, but search engines are also used in business settings. From December 2015 33.8% of companies had Internet-based marketing activities and more than half (47.4 percent) had invested launched in search engine marketing.

Online sales and marketing efforts in China are still in the early stages of development, but their use is growing rapidly with the growth of technology and e-commerce. A study by Nielson shows online sales currently comprise 11 percent of total retail sales in China, but it is at a significant rate increases - 53 percent! - Year for year. Not Google, but Baidu, Qihoo 360 Sogou.

When Western marketers on search marketing to speak, Google is the big player. However, it is a different story in China. Google links for censorship in 2010 China. Since then, when users enter Google.cn, they will be redirected to Google.hk which is the offer of Google presence Hong Kong. Even like this, only a few Chinese use Google.hk; right now, Google accounts for only 0.34% market share by the use in China. source seoagencychina

In China, the three best search engine players are Baidu, Qihoo360 (also known as Haosou) and Sogou. Baidu has 54.3 percent of the market share of the use, Qihoo 360 accounts for 29.24 percent and 14.71 percent holding Sogou.

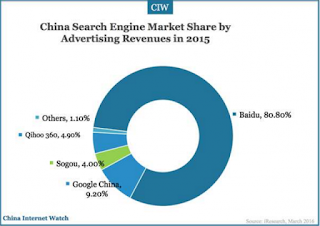

Search engine advertising revenue reached 68.26 billion RMB

In 2015, the entire search engine advertising revenue reached 68.26 billion RMB (US $ 10.55 billion) - an increase of 32.2.7 percent compared to last year, according to iResearch. In terms of revenue continues Baidu's Guide to be the Chinese search engine market (80 percent), followed by Google, Qihoo360 and Sogou

Thank you to Eric for the information